Jul. 03, 2025

5 minutes read

Share this article

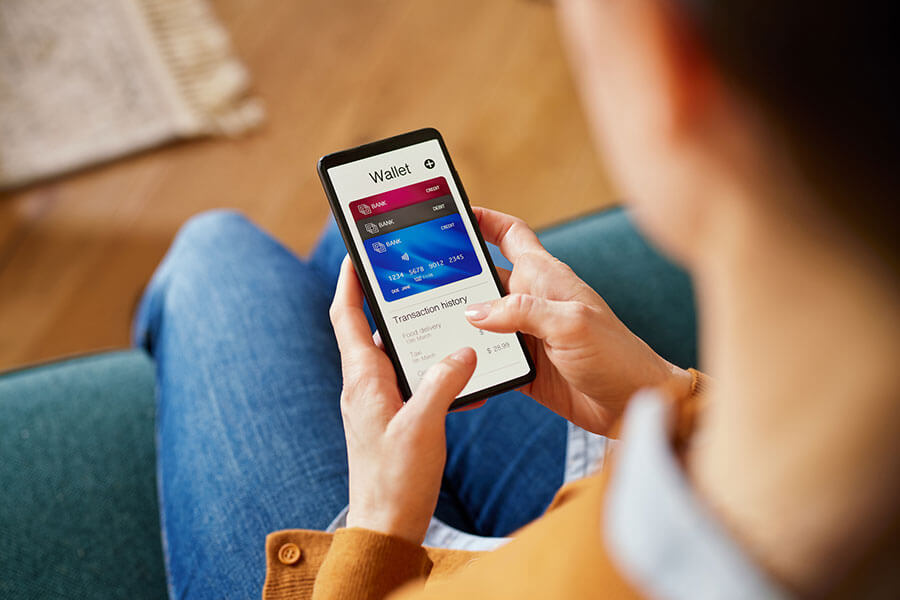

Imagine managing your savings, investments, loans, and even daily purchases through a single financial mobile app—one that not only simplifies your financial life but also offers personalized guidance through an intelligent assistant. This is not a distant dream; it’s the reality ushered in by the rise of super apps and AI assistants in the digital finance era.

These innovations are transforming how financial services are delivered and experienced, making finance more accessible, efficient, and user-friendly. But how did we get here, and what does the future hold? Let’s dive deeper.

Digital finance refers to the use of digital technology to manage financial services and processes. It encompasses a wide range of innovations, including online banking, mobile payments, and cryptocurrency platforms. At its core, digital finance aims to simplify transactions, enhance accessibility, and deliver a seamless user experience.

With the advent of super apps and AI assistants, digital finance has entered a new phase of evolution, offering integrated services and intelligent interactions that redefine user expectations.

Super apps are platforms that bundle multiple services into a single interface. Popularized initially in Asia by apps like WeChat and Alipay, super apps in finance are gaining traction globally. These apps enable users to perform a range of financial tasks—such as payments, budgeting, and investing—without requiring separate platforms. Financial super apps are driving digital finance transformation, offering a glimpse into the future of financial ecosystems.

AI assistants in financial services are intelligent tools that use machine learning and natural language processing to interact with users. They can handle tasks ranging from answering basic queries to providing sophisticated investment advice. AI assistants are enhancing customer interactions, making digital finance more intuitive and efficient.

Combining super apps with AI assistants creates a powerful ecosystem that redefines financial management. Imagine a super app where an AI assistant proactively notifies you about potential overspending, suggests adjustments to your budget, or even identifies better investment opportunities—all in real-time.

This synergy is driving the next wave of digital finance transformation, empowering users with more innovative and efficient tools.

While the potential of super apps and AI assistants is immense, some challenges must be addressed:

As the digital finance era evolves, we can expect:

Businesses and users alike must adopt these innovations to remain competitive in an ever-evolving financial landscape.

The rise of super apps and AI assistants marks a turning point in the digital finance era. By simplifying financial services and enhancing user experiences, these technologies are paving the way for a brighter, more accessible future.

As we continue to explore the potential of digital finance, understanding the role of integration and intelligence will be key to unlocking new opportunities. Whether you’re a business looking to innovate or a user seeking convenience, the era of super apps and AI assistants offers exciting possibilities for everyone.

Accelerate your software development with our on-demand nearshore engineering teams.