Over 60% of global banks spend over 70% of their IT budgets on maintaining old systems. This leaves little room for new ideas, making them less competitive. Modernizing banking systems is now a must, not a choice.

Old systems are more costly to maintain, slow down growth, increase security risks, and make it challenging to follow new rules. Customers want fast, easy access and intelligent services, but old systems cannot deliver them.

This article will identify five key signs that your systems are outdated. Act before they harm your business and cause you to lose customer trust.

The Current State of Legacy Banking Infrastructure

Modern banking heavily relies on old technology. Legacy systems, or outdated platforms, are still standard. Many banks have used COBOL-based mainframes since the 1970s and 1980s. This creates problems that slow down innovation.

What Constitutes a Legacy System in Modern Banking

Legacy systems include old software, hardware, or processes. A 2023 Federal Reserve study found that 70% of U.S. banks use over 20-year-old platforms. These systems often lack modern security, making it hard to follow new rules.

The Hidden Costs of Maintaining Outdated Technology

Keeping old technology costs a lot. According to Deloitte, banks spend 70% of their IT budgets on maintenance, not innovation. Finding COBOL developers and dealing with hardware costs are significant challenges.

Industry Trends in Banking Technology Adoption

There’s a big gap in technology adoption. Leaders like JPMorgan Chase and Bank of America have cut costs by 30% by moving to the cloud. But, slow adopters risk losing customers and facing fines. Moving to API-driven platforms is key to staying competitive.

Declining System Performance and Increased Maintenance Costs

Modern banking systems often reach a point where quick fixes no longer work. Reports show that 68% of banks face extended downtime due to old systems. As these systems age, problems worsen, leading to more patches and failures.

When Patches and Workarounds Become the Norm

Banks like Citigroup and Wells Fargo struggle with frequent patches. These patches make the codebase complex, slowing down transactions and increasing errors. This makes future upgrades very hard, trapping banks in a cycle of constant fixes.

The Escalating Financial Burden

A 2023 Deloitte report found that annual maintenance for old systems costs over 30% of some banks’ IT budgets. Hidden costs, such as lost revenue and penalties for not meeting standards, also contribute to this. Thus, keeping things running requires a lot of money.

ROI Analysis: Replacement vs. Maintenance

A 2022 Federal Reserve study compared Chase’s 2020 system upgrade with Bank of America’s delay. Chase spent $250M and saw a 4-year ROI from fraud cuts and efficiency. Bank of America paid $180M more without solving problems, showing upgrades can be more cost-effective.

Growing Security Vulnerabilities and Compliance Challenges

Old banking systems, which were created before today’s cyber threats, pose a significant security risk. They have large holes in data protection. Hackers find and exploit these weak spots. Even regular updates can’t fix all the problems, which causes banks to lose customer trust and face hefty fines.

Rules like GDPR and PSD2 require better data handling. However, many old systems cannot keep up. They lack the correct checks or encryption.

A 2023 report shows that 40% of fines are due to outdated systems. Old systems cannot always detect money laundering, which puts banks at risk of legal trouble. New systems are built with security and rules in mind. Cloud-based options have strong encryption and can spot threats quickly. They help banks follow new rules better.

Waiting for an update can lead to more problems. Banks might face fines and lose customer trust. For data protection, it’s better to keep up with new technology.

Inability to Meet Evolving Customer Expectations

Today’s banking customers want easy digital interactions. But old systems often can’t keep up. They expect quick services and tools that fit their needs. If banks don’t update, they’ll fall behind, hurting customer happiness and loyalty.

The Digital Banking Experience Gap

People compare banking to services like Venmo and Google Pay. They want fast, 24/7 transactions. A 2024 statistics report by J.D. Power shows that 72% of users find real-time updates key. But old systems can’t match this, leading to unhappy customers.

Mobile and Omnichannel Banking Requirements

The Federal Reserve said mobile banking use soared to 89% in 2023. Yet, old systems struggle to keep up with mobile apps. They can’t send instant alerts or sync data across devices, making banking less smooth and accessible giving rivals an edge.

Customer Retention Risks in a Competitive Market

A Deloitte report says financial firms lose 30% of customers each year, often because of inadequate digital tools. Young people prefer apps over visiting branches. Banks that don’t update will lose out to fintech and digital-first rivals. They must update their systems to meet user demands and adjust to new standards like Open Banking.

Modernization of Legacy Systems in Banking: A Strategic Imperative

Modernizing and migrating legacy systems in banking is now essential for staying competitive. Banks must see this as a key part of their digital transformation, ensuring they remain relevant and profitable in a rapidly changing market.

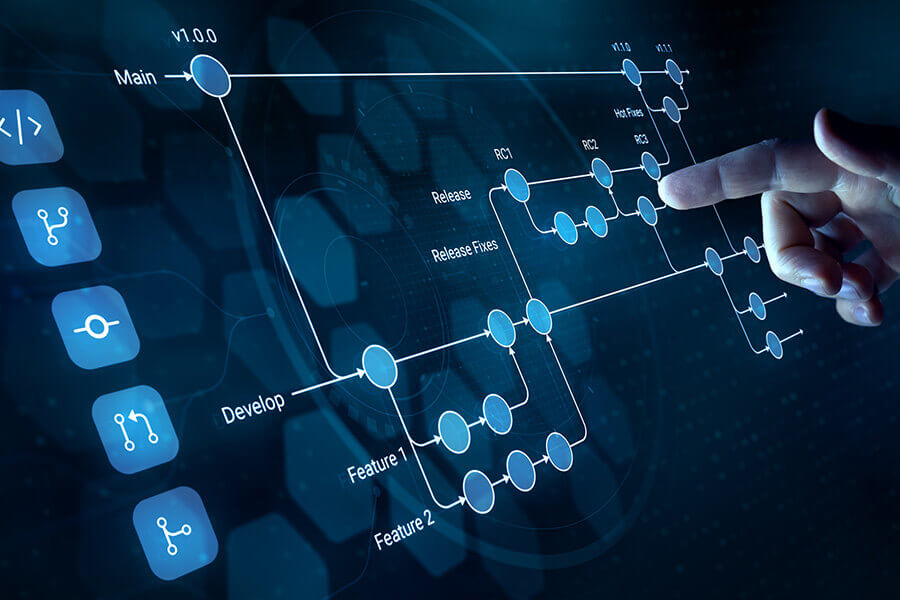

Transformational vs. Incremental Approaches

Transformational modernization involves replacing old systems with new ones. It offers full integration with the latest technology but requires a lot of resources. Incremental approaches update parts of the system, delivering quick wins but less risk.

The right approach depends on the bank’s readiness. Transformational approaches are for those ready to change everything, while incremental approaches are for those who want to innovate incrementally.

Building the Business Case for Modernization

Showing the ROI of modernization starts with counting the savings from less downtime and risk avoidance. Banks must also consider the benefits of better customer service and the ability to work with fintech companies.

A 2023 Federal Reserve study showed that 68% of banks see ROI within three years after modernizing. This is thanks to smoother operations and new ways to make money. Getting everyone on board is key to making modernization a lasting advantage.

- Difficulty Integrating with New Technologies and Third-Party Services: Old banking systems often can’t keep up with new tools. They struggle to work with innovations like AI and blockchain. Issues like outdated APIs and security make it hard for banks to work with fintech or adopt new tech.

- API Compatibility Issues with Legacy Platforms: Many old systems lack APIs that work well with cloud services or fast payments. Banks have to spend a lot to fix these problems. They want to use open banking and fight fraud quickly, but they can’t because of these tech issues. They need unique solutions to overcome these problems. This is key to staying ahead in the tech race.

- The Innovation Bottleneck Effect: These tech problems slow down new product development. For instance, a bank might hold off on mobile services or biometric login. Without the right APIs, working with fintech or blockchain is hard. This limits banks’ chances of profiting from digital changes, weakening their edge in a fast-paced market where speed is key.

Comprehensive Benefits of Banking System Modernization

Modernizing legacy systems has many benefits. Banks gain a competitive advantage by launching products faster, and they can also quickly adapt to market changes.

Real-time data helps offer personalized services, such as tailored loan offers and fraud alerts, which improve the customer experience.

These upgrades also cut costs. Automated workflows reduce manual tasks. Cloud-based solutions can lower hardware costs by up to 30%, significantly reducing costs.

Modern platforms let banks create new services, such as AI-driven investment tools and blockchain payments, which were complex to offer with old systems.

With better analytics, banks can understand customer behavior better. This helps them keep customers happy. Banks can also partner with fintechs to create new apps and generate new revenue streams.

Scalable systems quickly handle more data and rules. A modern system ensures banks can keep up with changes, making technology a key to growth rather than just a tool for survival.

Implementation Strategies and Common Pitfalls to Avoid

Modernizing legacy systems requires careful planning to avoid problems. This section discusses updating your system, covering crucial steps and common mistakes, such as data migration errors or skill gaps.

Cloud Migration Considerations for Banking Institutions

Cloud services like AWS or Microsoft Azure are scalable but come with challenges. Banks must focus on data location rules and use hybrid cloud models. This meets legal standards. Security checks and partnerships with vendors help during the transition.

Data Integrity and Migration Planning

Data migration requires thorough checks to avoid quality issues. Teams must understand legacy systems and clean data and test them simultaneously. Automated tools help reduce mistakes and ensure smooth changes.

Addressing Organizational Skill Gaps and Change Management

When new systems are introduced, existing staff may lack the tech skills to maintain and update them. Training and mentorship help teams adjust; good communication and leadership support make the transition smoother. IT Staff Augmentation is a quick and efficient solution for this stage and allows financial institutions to gradually adapt to new systems without risking critical problems.

Conclusion: Embracing Digital Transformation in Banking

Legacy systems in banking are no longer enough to stay ahead. They show signs of poor performance and security issues. It’s time for a change. Even Modernizing Legacy System with AI is something that needs to be seriously considered for financial institutions.

Modernizing banking systems is more than just updating tech. It’s a strategic move to stay relevant. Banks that wait to modernize risk being left behind by those using cloud and real-time data.

Moving to new platforms makes banks more agile. They can quickly meet customer needs and comply with regulations. Banks like JPMorgan Chase and Bank of America have significantly improved efficiency and innovation.

Modernizing banking systems is crucial. It allows banks to work better with fintech and develop new products. While there are challenges, not changing is riskier. Modernizing helps banks adapt to economic changes and technological updates.

Banking leaders should see modernization as an ongoing process. Working with experts and taking it step by step can help. Investing in modernization brings benefits like growth and strength. Banks that embrace digital transformation will lead in a fast-changing financial world.